Business and Economy

Canada is getting poorer when compared to its wealthy peers, data shows

By John Paul Tasker, CBC News, RCI

And the wealth gap between Canada and the U.S. has only grown wider, according to figures published by the Organisation for Economic Co-operation and Development (OECD). (Pexels Photo)

Tepid economic growth, combined with a population boom, has hit Canada’s standing among rich countries

Canada is among the richest countries in the world — but when compared to peer countries like Australia, New Zealand and the United Kingdom, it isn’t as rich as it once was.

And the wealth gap between Canada and the U.S. has only grown wider, according to figures published by the Organisation for Economic Co-operation and Development (OECD).

Canada’s relatively weak economic growth, combined with a population boom, has hit its standing among wealthy countries.

It’s one reason why Prime Minister Justin Trudeau has turned to former Bank of Canada governor Mark Carney to give him and his cabinet advice (new window) on how to juice economic growth.

Treasury Board President Anita Anand is also launching what she calls a working group

to study the country’s lacklustre productivity and find ways to boost economic output.

The Bank of Canada is also seized with the issue. In March, Deputy Governor Carolyn Rogers sounded the alarm about the need to boost Canada’s productivity.

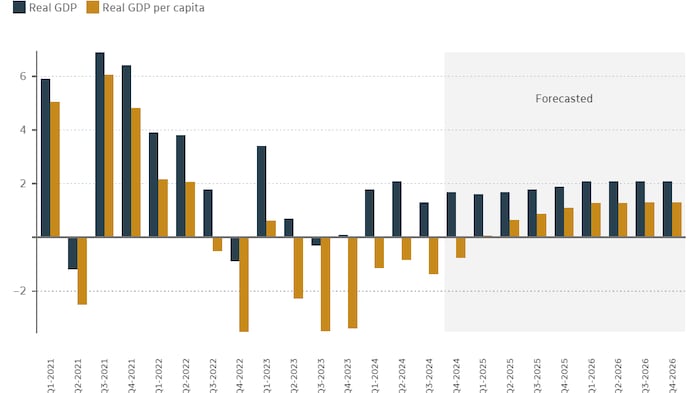

Canada’s GDP numbers. Photo: TD Bank (CBC)

You’ve seen those signs that say, ‘In emergency, break glass.’ Well, it’s time to break the glass,

she said in a speech (new window).

Recent Statistics Canada data (new window) shows why: Canada’s economy is growing overall but at a disappointing rate relative to population growth.

The country added nearly 1.3 million people (new window) last year — a 3.2 per cent increase — while the economy grew by just 1.1 per cent (new window) in the same time period. That means more people taking slices out of an economic pie that hasn’t grown much bigger.

The news isn’t all bad. Data shows real weekly earnings — a person’s take home pay — has actually increased in Canada, even when accounting for inflation. The household savings rate is also up.

And there may be some improvement on the horizon; Canada’s economic growth is expected to hit 1.3 per cent in 2024 (new window) and 2.4 per cent the year after, according to International Monetary Fund (IMF) data.

A country’s wealth can be measured by dividing the size of its economy by how many people live there. In economic circles it is known as GDP per capita

and it’s an important indicator of living standards.

Gross domestic product, or GDP, is the total value of goods produced and services provided in a country in a given year. On a per capita basis, GDP fell 0.1 per cent in the second quarter of this year — the fifth consecutive quarterly decline (new window), according to Statistics Canada.

‘We’re getting collectively poorer’: former BoC deputy

Paul Beaudry served as deputy governor of the Bank of Canada from 2019 and 2023 and is now a professor at the Vancouver School of Economics at UBC.

Relative to other countries, we’re getting collectively poorer,

Beaudry told CBC News. And it’s not only relative to the U.S., it’s relative to a lot of other countries. We’re in the laggard group.

A rising GDP per capita means there’s more wealth to go around — including for governments, which can collect more tax revenue from a growing economy without necessarily raising taxes.

Growing GDP per capita allows us to be richer and have all the things we want more of, like public services, health care and education. And we’re falling behind,

Beaudry said.

The U.S. has been wealthier than Canada for a long time.

In 2002, Canada’s GDP per capita was about 80 per cent of what the U.S. generated — although much of that country’s wealth is concentrated (new window) in the hands of a relatively small number of people.

But by 2022, Canada’s GDP per capita was just 72 per cent of that of its neighbour to the south, a decline that means the U.S. has an even bigger leg up over Canada when it comes to living standards.

That gap between us and the United States is not just large today. It has been widening at a pace that we haven’t seen in generations,

said Trevor Tombe, a professor of economics at the University of Calgary.

Because Canada hasn’t kept pace, emigration to the U.S. could start to accelerate, said Larry Schembri, a senior fellow at the Fraser Institute and a former deputy governor of the Bank of Canada.

As that gap grows, more and more Canadians have an incentive to move to the U.S. for better economic opportunities and a higher standard of living,

he said, adding doctors and tech workers may be among the first to go.

But Canada isn’t just falling further behind the U.S. — a country with massive budget deficits that have helped to fuel its impressive economic growth.

For the past two decades, Canada’s GDP per capita has been higher than the OECD average of the world’s 30 most developed countries.

‘We don’t want to become another Argentina’

In 2002, Canadian GDP per capita was 8.6 per cent higher than the OECD average — a point of pride that meant Canada was outperforming other advanced economies.

But that changed in 2022 as Canada’s GDP per capita slipped below the average, according to OECD data compiled by (new window)Schembri and the Fraser Institute (new window).

At $46,035 US per capita, Canada ranked just below the OECD average of $46,266 US in 2022.

I don’t think we want to see a future for Canada where we lag behind all these other countries and we just get poorer and poorer over time,

Beaudry said.

We don’t want to become another Argentina,

he said, referring to a once-rich country that was mismanaged for decades and is now a middling economic force. That’s why we have to worry about this.

Notably, Canada has lost ground to peer countries like Australia, New Zealand and the United Kingdom.

Canada and Australia were equally as rich in 2002, but today, Canada’s Commonwealth cousin is now wealthier.

Canada’s GDP per capita was almost identical to Australia’s in 2002 but it fell to 96.6 per cent of Australia’s by 2014 and to 91.2 per cent by 2022.

Canada has a higher GDP per capita than New Zealand, but that Commonwealth country has been closing the gap. So has the United Kingdom, despite the economic shock of Brexit and other convulsions.

WATCH: Why it feels like we’re in a recession (when we’re not)

Why it feels like we’re in a recession (when we’re not) | About That

Canada’s economy is showing many hallmarks of a recession — rising unemployment and bankruptcies, less consumer spending — yet it’s still growing. Andrew Chang explains the disconnect and what may be behind it all.

It’s the gap between Canada and other non-U.S. developed countries that’s a particular cause for concern, Tombe said.

It’s not just a unique American success story, it’s really a story of Canada’s economy lagging behind where we’d like it to be,

he told CBC’s Power & Politics.

GDP figures ‘kind of misleading’: PM’s former adviser

Tyler Meredith is a former Trudeau adviser who helped craft the government’s fiscal and economic policy.

Meredith told CBC News the slumping GDP per capita figures are kind of misleading

because they have been so skewed by outsized population growth in recent years.

He said the Liberal government he used to work for has allowed too many temporary foreign workers to come in.

We need less temporary migration, we need less foreign students and probably less foreign workers in low-skilled categories,

he said.

But he pointed to data that shows take-home pay has increased, even when accounting for inflation. The household savings rate is also up as more people have money socked away thanks to higher wages.

Those two things speak directly to the question of, ‘Do I have enough income to be able to afford the lifestyle that I want or buy the things that I need?’

he said. It’s not obvious to me that people are concerned about GDP per capita.

Meredith said Canadians are still well off, even if economic growth has been weak

and unemployment rates have ticked up.

Meredith acknowledged that U.S. economic growth has been gangbusters, beating the rest of the world,

and he said Canada’s slower growth has been a bit more severe than other countries.

How can Canada turn things around?

Beaudry said there isn’t one overriding reason explaining why Canada fell behind.

He said Canada’s lax immigration policy in the post-COVID period has been a drag on collective prosperity.

Beaudry said Canada is overburdened

with newcomers and it’s hard to integrate so many people — particularly low-wage, low-skilled workers — into the economy in such a short period of time.

The Bank of Canada’s recent monetary report pegged the immigrant unemployment rate at nearly 12 per cent — much higher than the overall rate.

If Canada were to rein in the number of newcomers, there would be some short-term improvement to the GDP per capita figures — but it wouldn’t necessarily address the other factors that have caused Canada to slip over the last 20-plus years, Beaudry said.

Beaudry said Canada has a weak corporate culture where competition is virtually non-existent in some critical sectors and big firms spend less on technology and upgrading workers’ skills — two things that can boost productivity and national wealth.

Schembri said Canada is also beset by longstanding interprovincial trade barriers — a tangle of regulatory red tape that premiers talk a lot about but do little to fix.

The federal government also needs to focus less on redistributing the wealth we already have and more on growth, Schembri said. Tax incentives to keep high-skilled workers in Canada would also help, he said.

The federal government’s recent move to increase the capital gains inclusion rate has the potential to make people and businesses invest less than they do now, Tombe added.

What we’re seeing in Canada is an increase in the effective tax rate we levy on investments. We’re really moving in the opposite direction that we should,

he said.

The government maintains a tax increase on disproportionately wealthier people and corporations is the best way (new window) to fund new social programs like dental care and pharmacare, and an ambitious housing plan.

Meredith said the government needs to find ways to encourage corporate Canada to spend more and unlock some of the dead money

they have sitting on their balance sheets but don’t use.

The longstanding Canadian practice of launching a Royal Commission to deal with seemingly impenetrable issues could be part of the solution in this instance, Tombe said.

Shining a bright light on all areas where Canada can improve — that might help,

he said.

This article is republished from RCI.