Business and Economy

Enacting CREATE into law to help PH economy recover

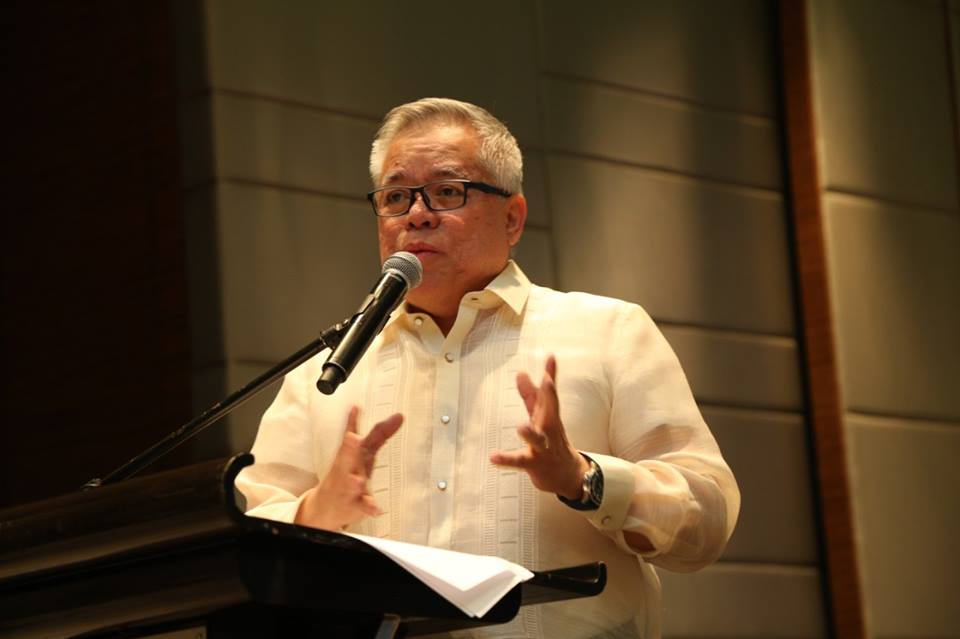

On Wednesday, Lopez said the DTI believes that the CREATE law is a “big boost to attract foreign investors in the country”. (File Photo: DTI Secretary Ramon M. Lopez/Facebook)

MANILA – Trade officials believe that the enactment of the CREATE bill into law will usher the country’s economic recovery next year.

Department of Trade and Industry (DTI) Secretary Ramon Lopez said that as the government will continue to implement its recovery plan next year, signing the CREATE bill into law is vital as this defines the country’s future incentive regime.

On Wednesday, Lopez said the DTI believes that the CREATE law is a “big boost to attract foreign investors in the country”.

Many foreign investors have put their investment plans on hold as they are waiting for the final structure of incentives under the CREATE bill, he added.

“Our MSMEs will benefit the most from CREATE, as it provides for an immediate 10-percent reduction in the CIT (corporate income tax) rate, bringing it down to 20 percent from 30 percent at present,” Lopez said during the Manufacturing Summit 2020.

He added that the CREATE would also give income tax holiday of four to seven years to export and domestic enterprises in activities classified as critical industries and a 5-percent special corporate income tax rate (SCIT) based on gross income earned, in lieu of all national and local taxes for 10 years.

In the same virtual event, DTI Undersecretary Ceferino Rodolfo echoed that Senate Bill 1357 has removed the nationality and export bias of giving tax perks to investors.

Under Executive Order 226, the Board of Investments (BOI) is not allowed to provide incentives to foreign companies investing here to manufacture products to be sold to the domestic market.

“We should be able to incentivize those who are going to locate their facilities here regardless of ownership as long as (the) value add and the employment will be here in the Philippines,” Rodolfo said.

The CREATE, once enacted into law, will help in developing local supply chain networks, he added.

The CREATE will give incentives for companies that source their raw materials locally that would help to develop the local micro, small, and medium enterprises rather than importing the cheapest price of input components from any other place in the world.

Rodolfo added that coupled with Bayanihan to Recover as One or the Bayanihan 2, the administration’s tax reform program will help in the economic recovery amid the Covid-19 pandemic.