Sports

Pandemic Moneyball: How COVID-19 has affected baseball odds

The ground-breaking 2004 book Moneyball by Michael Lewis exposed the use of advanced baseball statistics by the Oakland A’s and the team’s general manager, Billy Beane, to excel in the competitive Major League Baseball marketplace. The book resulted in the resurgence of the use of data analytics tools in MLB and then other sports.

I’m a baseball fan, but in my day job I research game theory as it’s applied to financial situations and data analytics. So I was curious to understand the lasting impact of the “Moneyball effect” on baseball. My research examined the “arms race” among MLB teams and how they tried to gain a strategic advantage by using proprietary data tools.

The successful implementation of data analytics by the Oakland Athletics to find undervalued players explained why the team made it to the playoffs each year between 2000 and 2003, despite having one of the lowest payrolls in MLB.

Ironically, the loss of this strategic advantage by the A’s is related to the publication of Moneyball — which became a larger cultural phenomenon when a movie by the same name (starring Brad Pitt as Billy Beane) was released in 2011.

A tool used by all teams now

Before the book was published in 2004, only five MLB teams had established an analytics department within their organizations. By 2017, all 30 teams were using advanced analytics to assess player performance.

Small-market teams like Oakland lost their competitive advantage as richer teams like the Los Angeles Dodgers, Boston Red Sox and Chicago Cubs added advanced analytics to their toolkits.

It’s one thing to be a Moneyball team; it’s another to be a Moneyball team with money. Not only can the richer large-market teams go after the best players, but they can also poach key front office people from the poorer teams.

Consequently, it’s not an accident the Dodgers have appeared in three of the last five World Series — including their win in 2020. The fact that their opponents last year, the small-market Tampa Bay Rays, even made it to the World Series is nothing short of a miracle.

The ‘haves’ and ‘have nots’

One of the problems with baseball’s asymmetric payrolls means teams can be divided into “haves” and “have nots” (with a few franchises falling into a middle group). And those “have nots” now have another issue to deal with: the impact of the COVID-19 pandemic on baseball revenue.

No spectators were allowed at MLB regular-season games last year and each team has taken a different approach to fans in the stands this season. But in most cases, teams will limit attendance to allow social distancing among the fans.

While all teams will see a loss of gate revenue because of the pandemic, poorer teams will suffer more. Richer MLB teams have other sources of income and substantially larger financial resources, enabling them to weather the storm better than the “have nots.”

MLB teams lost US$1 billion in 2020, compared to a profit of $1.5 billion in 2019. Forbes magazine has estimated MLB’s total revenues dropped to $4 billion last year from $10.5 billion in 2019.

And the pandemic has also had an impact on a revenue-sharing program that was first established by MLB in 1996 to lessen the economic inequalities between “have” and “have not” teams. The program was suspended last year and is only happening in a limited capacity this year.

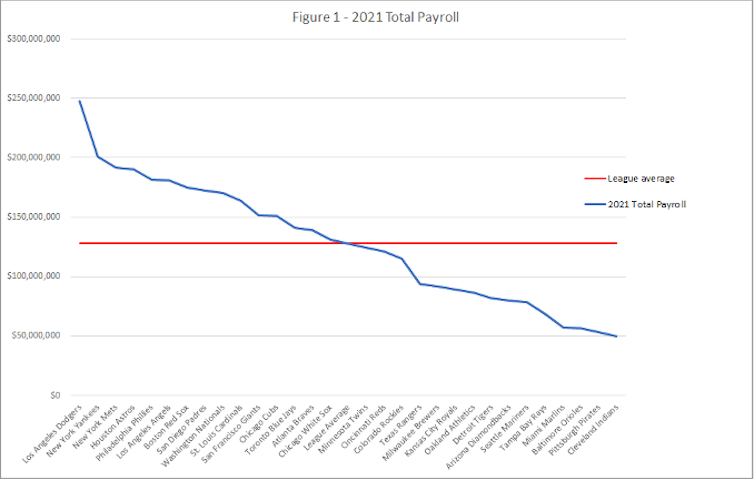

Dodgers top total payroll

To better understand the gap between the “haves” and the “have nots,” let’s look at the 2021 MLB payrolls. The Dodgers are at the top with a total payroll of almost US$250 million while Cleveland is at the bottom with at $49.7 million.

The teams that won the World Series in the past five years (the Cubs, Astros, Red Sox, Nationals and Dodgers) are all in the top third of total payroll in 2021. And eight out of the 10 teams that participated in the past five World Series are from the top third of total payroll in 2021 — the only two exceptions are Cleveland in 2016 and the Rays in 2020.

We already know small-market teams like Oakland no longer have a competitive advantage when it comes to using Moneyball analytics. So do they have any hope of winning it all during another season of pandemic baseball?

What is the key to winning?

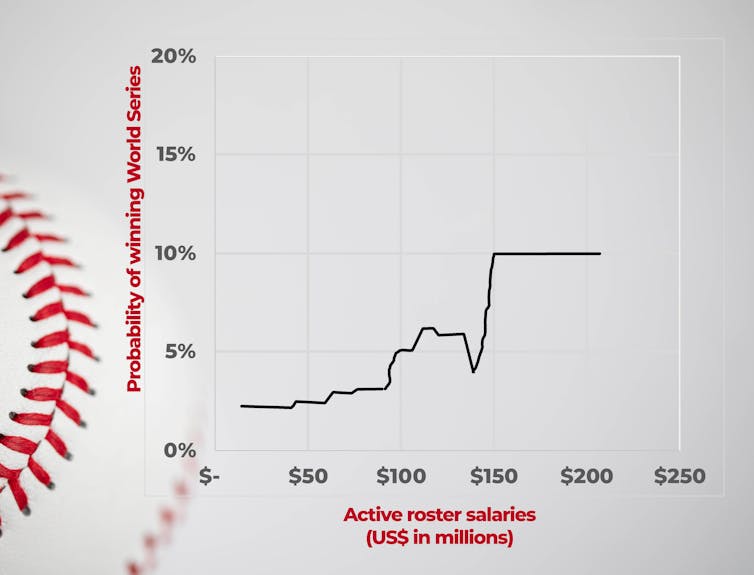

To under the relationship between team salaries and the odds of winning the World Series, I did an analysis with machine learning algorithms. These type of algorithms create models that train themselves and learn from their mistakes in an iterative manner and can predict outcomes based on available data.

The analysis showed that a key metric is the payroll of a team’s 26-man active roster — which is different than total payroll because it excludes salaries of injured, suspended or those no longer playing for the team but still being paid.

My model suggests that teams with an active-roster payroll of less than $50 million — specifically Cleveland ($49 million), Pittsburgh ($40.7 million), Baltimore ($24 million), Tampa Bay ($40 million), Texas ($47 million) and Detroit ($48 million) — have almost no statistical chance of winning the World Series.

Those with a payroll between $50 million and $150 million (teams like Miami, Arizona, Seattle, Oakland, Milwaukee, Colorado, Toronto, Kansas City, Cincinnati, Minnesota, Boston, White Sox, St. Louis, and Atlanta) have about a five per cent probability of winning it all.

Teams that are around the $150-million level are still at the same probability of five per cent. This includes San Francisco ($145 million), the Cubs ($145 million), Washington ($146 million) and Houston ($149 million).

Money only goes so far

But the model also suggests that once a team hits $150 million, the probability goes to 10 per cent and doesn’t go up even if salaries increase beyond that point.

This means the Dodgers, with a 26-man payroll of $211 million, are statistically no more likely to win the Series again this year than a team like the Mets with $152 million, San Diego with $155 million, Philadelphia with $160 million, the Yankees with $164 million and the Angels with $177 million.

It’s a tough time to be a small-market team in baseball. The Moneyball advantage is gone. COVID-19 has reduced revenue. And without a big payroll, it’s almost impossible to succeed.

What’s happening in baseball, it seems, is no different than what other business sectors are experiencing during the pandemic — the rich get richer and those less fortunate struggle to compete.

Ramy Elitzur, Associate Professor, Financial Analysis, University of Toronto

This article is republished from The Conversation under a Creative Commons license. Read the original article.