News

Palace sides with DOF: POGOs can be taxed

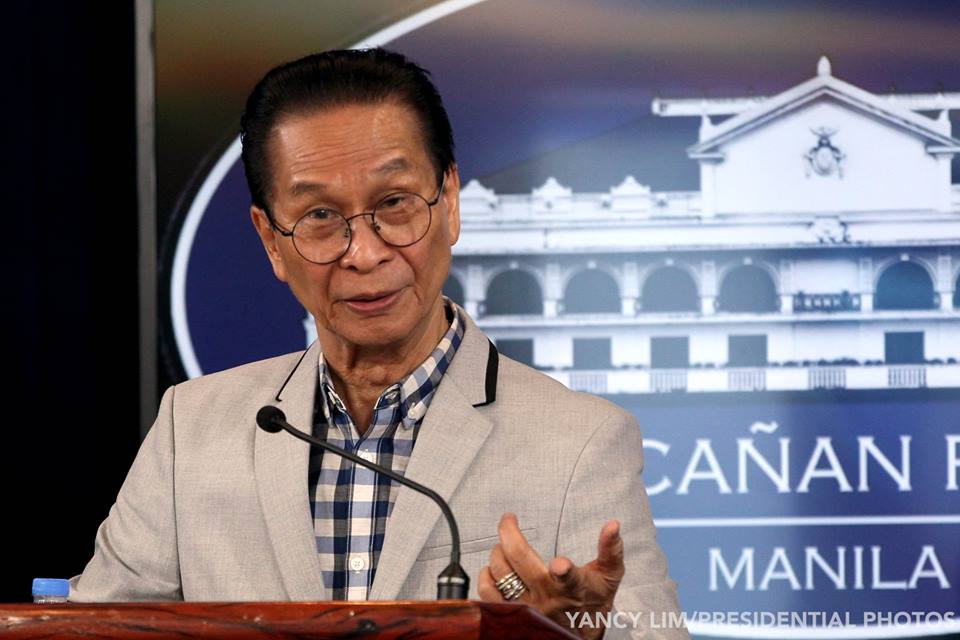

Presidential Spokesperson Salvador Panelo made this remark following conflicting statements made by Solicitor General Jose Calida and Finance Secretary Carlos Dominguez III on the taxability of the Philippine Offshore Gaming Operators (POGOs) licensees and service providers. (File Photo: Office of the Presidential Spokesperson/Facebook)

MANILA — The Philippine government can tax offshore gaming firms in the country, Malacañang said on Tuesday, insisting that the state cannot be denied of its authority to tax.

Presidential Spokesperson Salvador Panelo made this remark following conflicting statements made by Solicitor General Jose Calida and Finance Secretary Carlos Dominguez III on the taxability of the Philippine Offshore Gaming Operators (POGOs) licensees and service providers.

“While the matter is being studied at length by the DOF (Department of Finance), what is clear is that the State cannot be denied its right to collect on all applicable taxes on any entity or individual,” Panelo said in a statement.

Panelo said POGO workers’ “compensation, salaries or wages for the services they render here are considered “taxable income” under Section 23 (A) & (D) of the National Internal Revenue Code.

“For POGOs that are domestic corporations, they are covered by Section 23 (E), Chapter II of the National Internal Revenue Code (NIRC) and their income shall be subjected to Philippine taxes regardless of whether the same was derived from a source outside of the Philippines,” Panelo said.

“As for those POGOs considered as foreign corporations, they too are taxable but only for income which they derived from sources within the country. This is pursuant to Section 23 (F), Chapter II of the NIRC,” he added.

The Palace official emphasized that the DOF has the primary mandate to formulate, institutionalize, and administer fiscal policies.

He said the discretion of the DOF, alongside the Bureau of Internal Revenue (BIR), carries “significant weight on matters of taxation.”

“With this, we trust that the DOF, together with the BIR, has the competence to evaluate the respective charters and operations of these entities in order to subject them to Philippine taxes in accordance with the law,” Panelo said.

Quoting the Supreme Court in a plethora of cases, Panelo said “Taxes are the nation’s lifeblood through which government agencies continue to operate and with which the State discharges its functions for the welfare of its constituents.”

Panelo, also Chief Presidential Legal Counsel, explained that the State has the authority to tax in order to defray the expenses of the government.

He maintained the Duterte administration will not be “stymied nor estopped by technicalities caused by the exploitation of developing technologies in collecting what is due the government.”

Meanwhile, Panelo acknowledged that Calida’s statement was an opinion given to the Philippine Amusement and Gaming Corporation (Pagcor) based on the “source of income” principle under the country’s tax code.

Calida said the test of taxability “is the source and correspondingly, the source of an income is that activity which produced the income.”

Dominguez, on the other hand, said because POGOs are providing services to their counterparts in the Philippines, they are subject to income tax.

Panelo said Calida’s remark is subject to change, depending on the circumstances.