Business and Economy

Transferring money to Philippines from Canada

The transfer of funds between countries. A struggle we all know all too well, but seems like wherever we turn our head, there are more fees lurking in the shadows to suck down our wallets one dollar at a time.

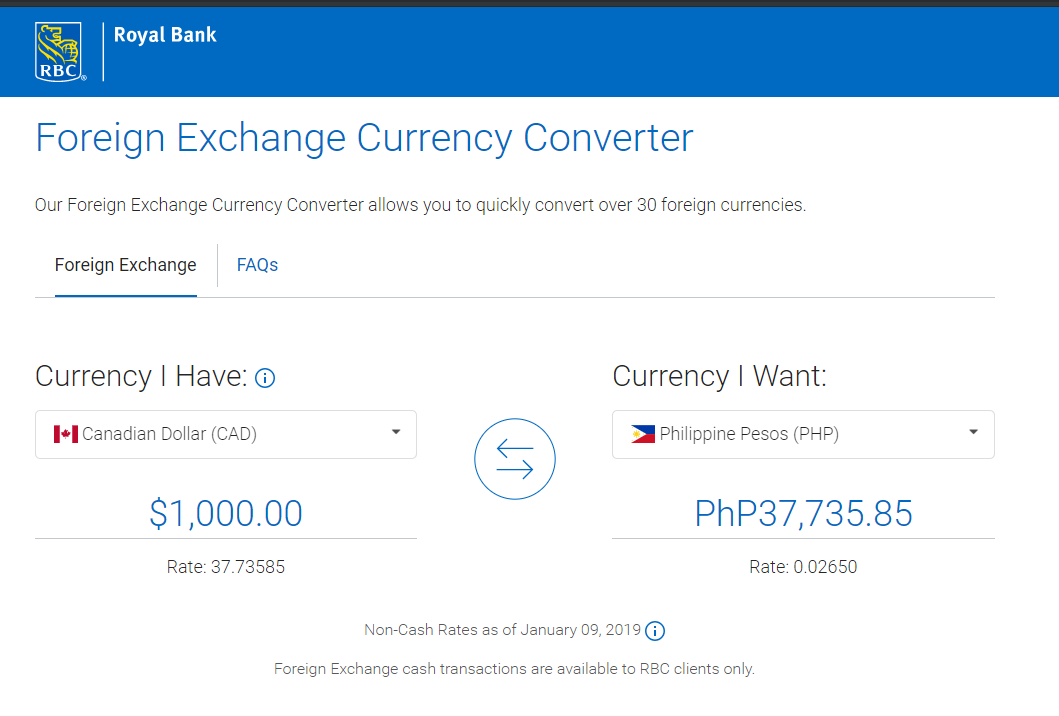

Have you ever tried stepping to your nearest bank and ask them to transfer money to the Philippines? If you used this option, it is very likely to believe – unless you have a premium account at the bank, or a specifically cheap bank – that you have lost more than 5% of the total transfer value in fees. With RBC for example you are going to get shafted brutally. As of January 9, they offer 37,735 PHP per $1,000 Canadian dollars. The real exchange rate is 39,516 PHP so in fact you are losing almost 2,000 PHP, or 5% of the transaction.

So, how do you go about transferring money from Canada to the Philippines or from the Philippines back to Canada?

Many people attempt to transfer significant amounts of money in cash through hand delivery. There are always relatives travelling one way or another, and there are no transfer fees with the exception of the currency exchange fees. The problem with this method is that it’s illegal over certain amounts, and that it’s very risky.

Another thing that expats and immigrants across the globe often do is to contact money transfer agencies like Western Union or Moneygram. They are very easy to use, and the recipient can pick up the funds in cash. The problem? In some cases this method will be even more expensive than a bank. Western Union and Moneygram has been exploiting immigrants for more than a century by now and they are going to apply the highest possible markup and fees they can, the less alternatives the sender has, the higher the fees he will be paying.

The third and preferable option is opting for bank to bank transfers via third party providers named currency transfer services. What they essentially do is receive your funds locally in the domestic currency, exchange it, and transfer it to the recipient in his own local currency, while applying much smaller margins than banks do. These are relatively small companies with minimal overheads, working by buying and selling in wholesale from their own banks, and hance, they are able to afford their services for reasonable fees.

Canada is a medium-sized market for these companies, which means that the biggest ones in the industry such as OFX, World First, HiFX or the likes are able to onboard Canadian clients with ease. Most of them have local Fintrac license as well as local offices and telephone numbers. They can also transfer the funds with ease from Canada to Philippines.

On the other hand, very few of these companies are able to onboard Filipino clients in the Philippines. The market is small, poor, and problematic to handle and as a result most of the companies give up on it. It doesn’t mean that there are no options at all. Companies like Azimo or World Remit are always happy to do it. They specialize in smaller volume remittances and their bread and butter are people who are residing in third world countries. Their markups will be closer to the 2% mark because of the additional manpower and legal support they need to recruit for their company in order to facilitate transfers from almost anywhere in the world.