Lifestyle

Use these remittance management tips to avoid fraud

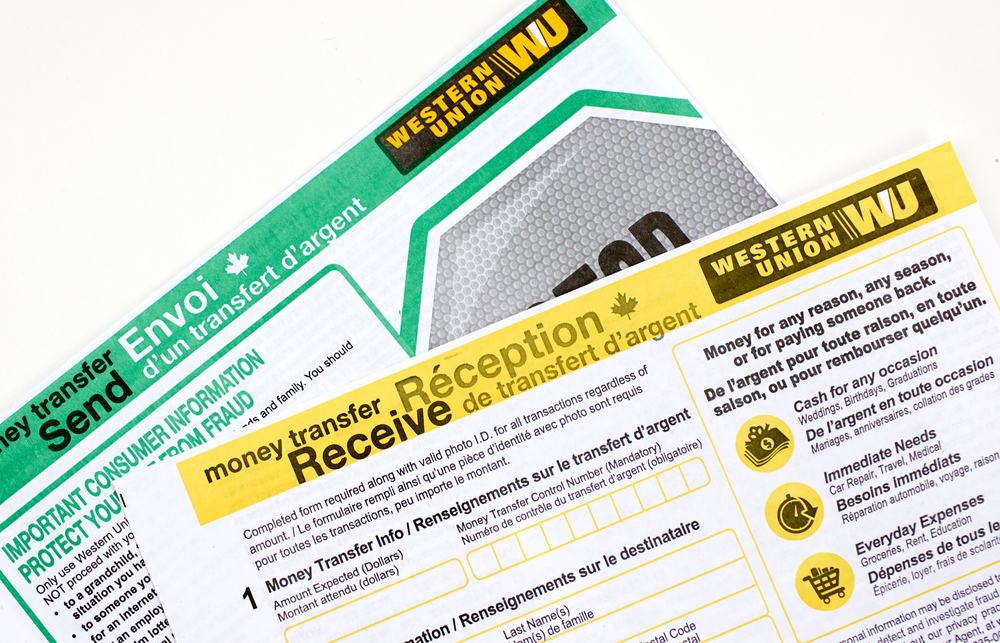

Western Union takes the issue of consumer protection very seriously by committing significant resources like funding, people, and technology to help consumers. (dennizn / Shutterstock.com)

March is Fraud Prevention Month

Here are some remittance management tips from Western Union that your readers should keep in mind when planning a money transfer:

- Stop and think—if it sounds too good to be true, it probably is.

- Know the person you are sending money to and only send and accept money from people that you have met in person.

- Research money transfer providers and ensure that transactions are able to be tracked.

- When picking a new provider, review news headlines and scan social media for any issues and talk to friends and family to learn more about their experiences with their preferred money transfer providers.

- Review all fine print, and terms and conditions before initiating or accepting a money transfer.

- Contact a consumer protection group about any suspicious phone call, email or social media message from providers or recipients.

buy zofran online health.royalcitydrugs.com/zofran.html no prescription pharmacy

Never send money:

- To anyone you haven’t met in person

- In advance to obtain a loan or credit card

- For an emergency situation without confirming that it’s a real emergency

- From a check in your account until it officially clears—which can take weeks

- For an employment opportunity

- To pay for taxes or fees on lottery or prize winnings

- For an online purchase

- For anti‐virus protection

- For a deposit or payment on a rental property

- To pay taxes

- For a donation to charity

- For a mystery shopping assignment

- To resolve an immigration matter

The Benefits of Choosing Western Union

In 2017, Western Union managed over 32 transactions per second and serviced 20,000 corridors across 200 countries and territories

- Western Union takes the issue of consumer protection very seriously by committing significant resources like funding, people, and technology to help consumers.

- Western Union works with trusted Canadian financial institutions, offering customers additional choice and convenience.

- Western Union has made significant technology enhancements to help protect consumers and the integrity of our money transfer network, including investments in:

- Technology to help detect and stop potentially fraudulent transactions in real time.

- Consumer fraud hotlines that allow customers to register fraud complaints – which helps prevent millions of dollars in fraudulent transactions annually.

buy xifaxan online health.royalcitydrugs.com/xifaxan.html no prescription pharmacy

- Over the last 10 years, the incidence of consumer fraud reports associated with Western Union consumer-to-consumer money transfers has been less than 0.1%