Business and Economy

30 years later, Wall Street remembers ‘Wall Street’

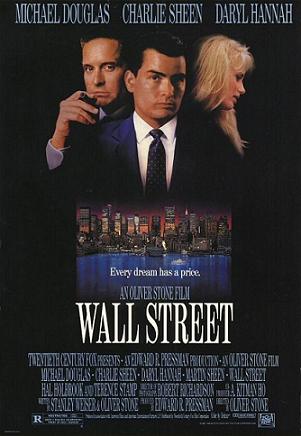

Thirty years after the release of the now-classic movie “Wall Street,” Wall Street itself is totally different. Or it hasn’t changed at all, depending on who you ask. (Photo By Source, Fair use)

Thirty years after the release of the now-classic movie “Wall Street,” Wall Street itself is totally different. Or it hasn’t changed at all, depending on who you ask.

To mark the anniversary Monday of the opening of Oliver Stone’s 1987 film, which starred Michael Douglas in an Oscar-winning, career-defining role as corporate raider Gordon Gekko, The Associated Press spoke to a group of Wall Street professionals, writers and film experts about how the movie reflected the reality of the financial world, and how little or much that world has changed in the decades since the movie’s release.

“The culture is the same. It’s all driven by greed. You don’t go into any of these businesses if you want to save the world or save puppies. It’s all about making money. If anything, I think the enormous explosion of wealth since then has made people greedier.”

— Michael Lewitt, investment manager and former trader at Drexel Burnham Lambert, an investment firm that was prosecuted for illegal activities in the junk bond market and later filed for bankruptcy.

The movie “dramatized the ethical and moral collapse of high finance during the Reagan Era. Regrettably, Gordon Gecko, Stone’s iconic symbol of unrestrained greed, would undoubtedly thrive in today’s madcap bull market. Indeed, we might even put him in the White House.”

— Raymond Arsenault, John Hope Franklin Professor of Southern History at the University of South Florida, St. Petersburg and author of “Stoned on Wall Street: The Stockbroker’s Son and the Decade of Greed.”

“The movie “Wall Street” accurately depicted the industry as the Wild West, a winner-take-all environment where, in the words of Gordon Gekko, “greed is good.” Whether the result of a couple of market meltdowns, the regulatory environment or public scrutiny, Wall Street has become kinder and gentler.”

— Jack Ablin, chief investment strategist for BMO Capital Markets.

“That movie is probably as relevant today as it was then. Things change, the markets change, but the attitudes of, for instance, Wall Street and corporate executives treating the average person as a pawn on a chessboard — I think that concept has not changed very much, and is still widely held.”

— Charles Geisst, Professor of finance at Manhattan College and author of the 1997 book “Wall Street: A History.”

“My take on “Wall Street,” just like my take on “The Wolf of Wall Street,” is that these things are overhyped, which you would expect in a movie. In my reality, while I may have lived through many parts of that movie … those episodes are a very small part of what actually happens.”

— Scott Wren, senior global equity strategist for Wells Fargo Investment Institute.

“One thing that’s probably changed a bit is that it’s harder to believe in the virtuous side of things, and more recent films like “The Wolf of Wall Street” are more accepting of the idea that everything is rotten from top to bottom. Or like “The Big Short,” now accept that it’s all about making money and have little room to show the virtuous people at the bottom. There is less criticism of capitalism per se. Even as critical as “Wall Street” can get of capitalism, it still ultimately exempts it from full criticism — it’s almost as if Gordon is such a bad apple that getting rid of him cures the system of its (localized and individualized) ills.

“Rewatching, the biggest change that struck me is around technology. It’s not just that the older technology looks old fashioned on screen, but that it can tell us about a major change in Wall Street: it’s now more virtual, more cybernetic, more about data manipulation, than ever. The climax where Gordon beats up Bud in the middle of Central Park seems a throwback to an older melodramatic time where you got to other people physically rather than informationally.”

— Dana Polan, Professor of Cinema Studies at NYU.

“I was in the trading pit during that time and despite what the movie portrayed, you simply didn’t wake up, go to work and make millions as if it were part of a daily routine. I think the movie also left viewers thinking Wall Street was full of crooked people – and while there may be a few bad actors like any other industry or profession, it’s been my experience that most people are here to do their jobs, help out others and make a living. Fast forward 30 years and the Wall Street of 1987 is radically different – and that’s a change for the better for the retail investor. Today the market is a much more level playing field for retail investors compared to 1987 in terms of market access, information and costs.”

— J.J. Kinahan, chief market strategist at TD Ameritrade.

“The film certainly has all the visual and audio affectations of the time in which it was made (“the go-go eighties”), but I think the message, while unfurled a bit sanctimoniously at times in the film, remains highly relevant (if not more relevant) than it was 30 years ago. There is even less penchant to heed the warning now, I sense, then than there was three decades ago.”

— John Stone, senior associate dean at the University of Wisconsin-Extension and author of “Evil in the early cinema of Oliver Stone: ‘Platoon’ and ‘Wall Street’ as modern morality plays.”

“Certainly more women are on the trading floor, or at least they’re not all secretaries. The intensity remains the same in terms of being driven for returns, but the behaviours have shifted. It’s become a little more professional.”

— Erin Browne, head of asset allocation at UBS Asset Management.