Breaking

Senate approves bill raising tax exemption ceiling on 13th month pay, other benefits

MANILA – The Senate on Wednesday approved on third and final reading a bill increasing the tax exemption ceiling of the 13th month pay and other benefits from the current Php30,000 to Php82,000.

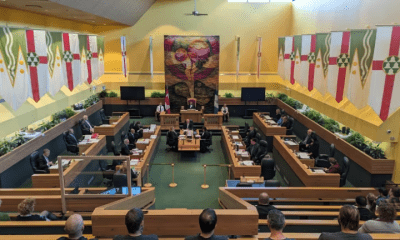

With 14-0 vote, the Senate passed Senate Bill 2437 or an act adjusting the 13th month pay and other benefits ceiling excluded from the computation of gross income for purposes of income taxation which was co-authored by all senators.

The original bill pegged the ceiling for tax-exempt bonuses at Php75,000 but was raised to Php82,000 upon the proposal of Senator Ralph Recto during plenary deliberations.

Angara, sponsor of the measure, accepted Recto’s amendments “because his proposal was the same figure given by internal Revenue Commissioner Kim Hernares during one of the hearings on the bill.

“She (Henares) said that Php30,000 in 1994 would be worth around Php82,000 today,” Angara said.

Senate President Franklin Drilon concurred with the hike, saying that the bill’s passage is necessary “to provide relief to state and private workers whose purchasing power has been shrinking for years due to inflation, but still have had to deal with the consequences of an outdated law.”

When the P30,000 tax ceiling was first legislated in 1994, Angara explained, the basic salary of a government employee in the lowest rung was Php3,800 a month while that of the President was P25,000.

The ceiling, Angara noted, had not been adjusted in 20 years although Congress had legislated other measures to soften the impact of inflation on the workers.

More importantly, Angara said, SB 2437 had included a provision “that the adjustment be made mandatorily every three years to coincide with major surveys conducted by the Philippine Statistics Authority such as the Family and Income Expenditure Survey.”

While some experts estimated that government would lose around Php42 billion in taxes with the enactment of SB 2437 into law, Recto argued that there was no basis for the computation.

A more reasonable computation of tax loss, he said, was estimated by the Philippine Institute for Development Students at Php2.6 billion and Dr. Stella Quimbo of the University of the Philippine School of Economics at Php5.6 billion.

“But whatever is the revenue loss for the government is actually income gained for the workingman. And even if his 13th month pay is tax exempt upon receipt, it will be taxable when spent,” Recto said, adding that taxes not withheld at source will later be captured in the form of sales tax at points of sales.

In response to concerns about the speedy implementation of the law, Drilon had also introduced an amendment to the bill stating that “the failure of the Secretary of Finance to promulgate the necessary rules and regulations shall not prevent the effectivity of the law.”.”This is because it is up to the Department of Finance and the Bureau of Internal Revenue to come up with the implementing rules and regulations when this law is passed, and they may not have enough time to accomplish that in time. But surely, the law will be fully implemented next year,” the Senate leader noted.