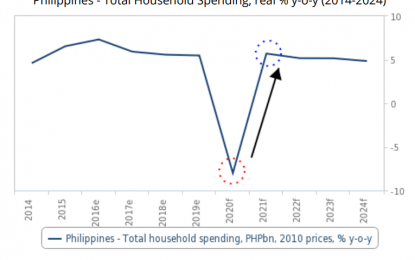

MANILA – A unit of Fitch Group forecasts a ‘V-shape’ recovery in consumer spending in the country by 2021.

In its commentary released on Friday, Fitch Solutions projected that the country’s household spending next year will grow by 5.7 percent from this year’s contraction of 8 percent.

It added that the household spending growth forecast for 2021 improved from the 5.5-percent year-on-year projection it estimated from a pre-pandemic environment in 2019.

“We predict that all of the main consumer spending categories will return to positive growth in 2021. Food and non-alcoholic drink spending were prioritized in household budgets in 2020, and so growth in spending on these items, while remaining positive, will be slightly lower in 2021,” Fitch Solutions said.

Fitch Solutions revised its growth projection for the consumer spending category due to the impact of the coronavirus disease 2019 (Covid-19).

Food and non-alcoholic drinks category is expected to increase by 9.3 percent this year from Fitch Solution’s pre-Covid projection of 8.4 percent; clothing and footwear spending is projected to contract by 15.6 percent from a pre-Covid growth forecast of 7.2 percent; alcohol drinks and tobacco spending revised to -16.7 percent from the initial forecast of 7.8 percent; furnishing and home spending, to -15.2 percent from 7.8 percent growth forecast; recreation and culture spending, now expected to decline by 17.8 percent from 1.1 percent contraction; and restaurants and hotels spending, down by 16.8 percent from pre-Covid growth forecast of 9.3 percent.

By 2021, all these categories are expected to increase between 5.3 percent and 15.3 percent.

Fitch Solutions noted that the drop in unemployment will aid household spending.

Government data show that the unemployment rate jumped to 17.7 percent amid the Covid-19 outbreak here and at the height of the lockdown measures in April. It slowed down to 10 percent in July when the government gradually relaxed community quarantine measures.

However, Fitch Solutions said that remaining restrictions such as on movement, curfew, and intercity and interstate travel are affecting Filipinos’ consumer spending.

“Continued restrictions on movement will dampen spending outlooks, especially in markets with under-developed e-commerce operations,” the Fitch unit said.

On the other hand, the downside risks to the 2021 outlook include renewed restrictions if Covid-19 daily cases continue to rise, delay in vaccine availability, and public backlash to new restrictions.

“Should movement restrictions be re-imposed, then there is a risk of public backlash. This could lead to governments placing greater restrictions on retail and hospitality operations. Protests would also decrease consumers’ desire to shop, travel, or dine out,” Fitch Solutions added.