WASHINGTON — The tea party class of 2010 vowed to usher in a new era for the Republican Party, one where conservatives clamouring for fiscal discipline would roll back government spending to rein in trillion-plus budget deficits.

Not anymore.

Republicans are returning to their Ronald Reagan-era roots — tax cuts first, followed by vague promises of cutting spending down the road. Concerns about growing budget deficits have been shelved as Republicans controlling Washington focus instead on delivering tax breaks along with spending increases for the military.

GOP leaders insist they haven’t abandoned their desire to confront trillion-dollar deficits. Looking toward 2018, House Speaker Paul Ryan has raised the prospect of tackling runaway benefit programs — with the spike in the deficit caused by the tax overhaul already being used to justify a potential round of austerity next year.

That would require political courage that’s rare in an election year in which Republicans face the prospect of daunting losses.

If history repeats, the spending cuts won’t be realized. Reagan’s assault on the bureaucracy sputtered. Republicans in Congress haven’t made a serious run at cutting spending since a failed 2011 budget deal delivered automatic cuts known as sequestration to Washington. Those, too, have unraveled.

And whether President Donald Trump’s tax cuts prove to be durable remains to be seen. Reagan’s 1981 tax cut was pared back several times. Three of the following four presidents — George H.W. Bush, Bill Clinton and Barack Obama — signed tax increases into law.

For now, the clear winners are the individuals soon to pocket tax cuts, along with corporations and businesses that stand to reap a windfall. The potential losers are the people who rely on the social safety net. But if Republicans fail, again, in their promises to wrestle the budget under control, the joke will be on the tea party base that thought it was voting for fiscal conservatism.

The budget deficit, which registered $666 billion in the 2017 budget year, is set to soar even higher, fueled by the tax cuts, a disaster relief total set to breach $130 billion, and long-promised, record budget increases for the military. Trillion-dollar deficits loom before the end of Trump’s term, which has Republicans already planning a pivot to long-promised curbs on government benefit programs such as food stamps, Medicaid and Medicare.

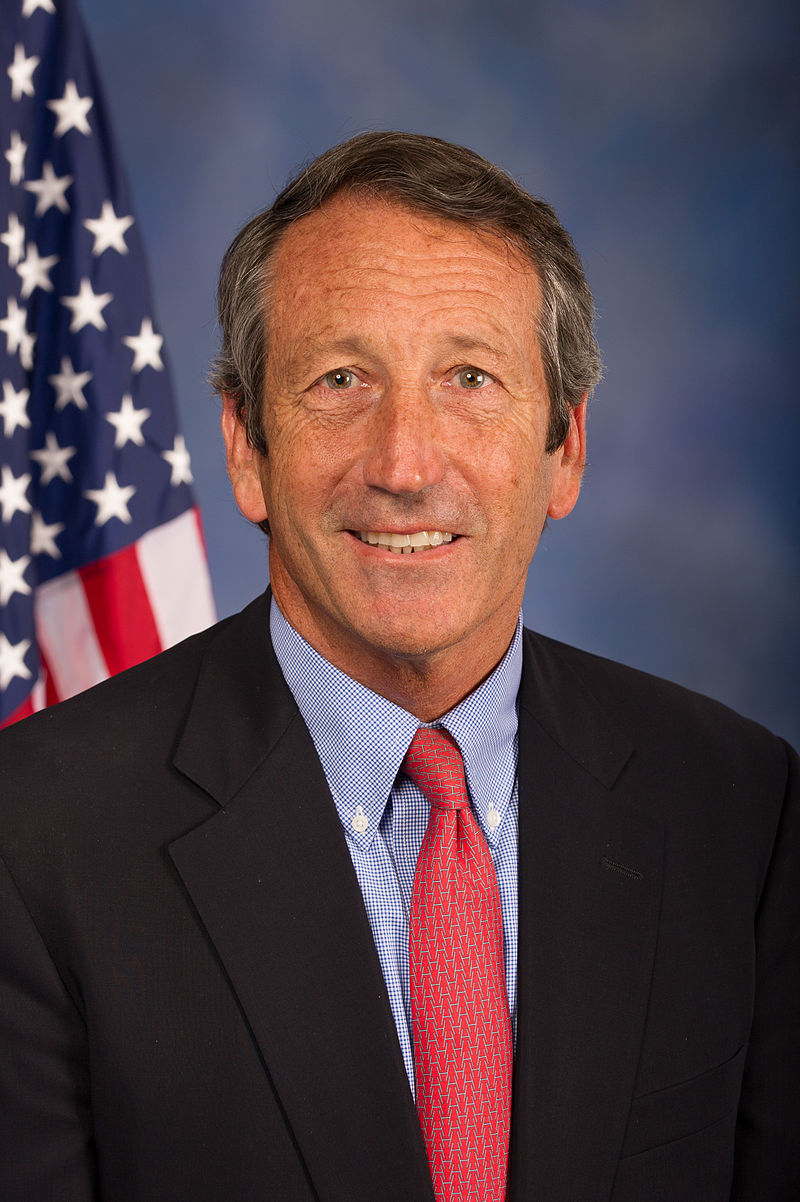

“There is no way out,” Rep. Mark Sanford, R-S.C., a member of the party’s deficit-hawk wing, said Tuesday. “The tax bill is in essence the nail in the coffin on driving the absolute mathematical necessity of reform to entitlement programs. You can’t have both.”

Ryan said in an interview Tuesday that “even if we get the kind of growth we hope to get (from tax cuts), you still have to reform entitlements if you’re going to get this debt under control. You cannot grow your way out of the entitlement problem we have coming.”

It bears noting that Republicans have promised spending cuts for years. The triumphant 2010 tea party class of GOP lawmakers who seized control of the House ran on fiscal discipline, and their demands for austerity brought the nation to the brink of default in the summer of 2011.

But the 2011 budget deal that delivered much-maligned automatic cuts to annual spending for agencies is unraveling, and controversial, long-promised curbs to the rapid growth of Medicare haven’t ever left the planning stages. Cuts in domestic programs such as food stamps or housing just won’t make a mathematical dent in the $20 trillion debt that future generations will bear.

Next year, the arrival of Doug Jones, D-Ala., will cut the Senate GOP advantage to just 51-49. The recent track record of Congress making difficult budget choices in election years doesn’t inspire confidence. And any potential savings from so-called welfare reform are dwarfed by the $1.5 trillion or more deficit tag for the tax measure.

“Once you cut taxes, it’s real hard to turn around and tell people you have to cut spending for fiscal responsibility,” said Brian Riedl, a senior fellow at the conservative Manhattan Institute. “Entitlement reform was hard before the tax cuts; it’ll be nearly impossible after.”

In passing the tax bill and then promising spending cuts later, Republicans are attacking the GOP policy menu like their predecessors — dessert first, vegetables later.

It’s a replay of the experience under President George W. Bush, who powered through tax cuts in 2001 and 2003 and the creation of a Medicare prescription drug benefit in 2003 as well. But when the agenda turned to cutting spending, particularly a 2005 bid to shore up Social Security, Bush flopped badly, while the tortured legislative path later that year to enact modest spending cuts of $40 billion over five years proved almost comically difficult.

In the 2006 midterms, the GOP president and Republicans lost control of the House and Senate.