MANILA — Malacañang on Monday welcomed the rating upgrade of the Philippines’ long-term foreign currency-denominated debt by one level, saying the rise in the ratings only shows the country’s consistent macroeconomic performance, its sound economic policies and its position as one of the fastest expanding economies in Asia.

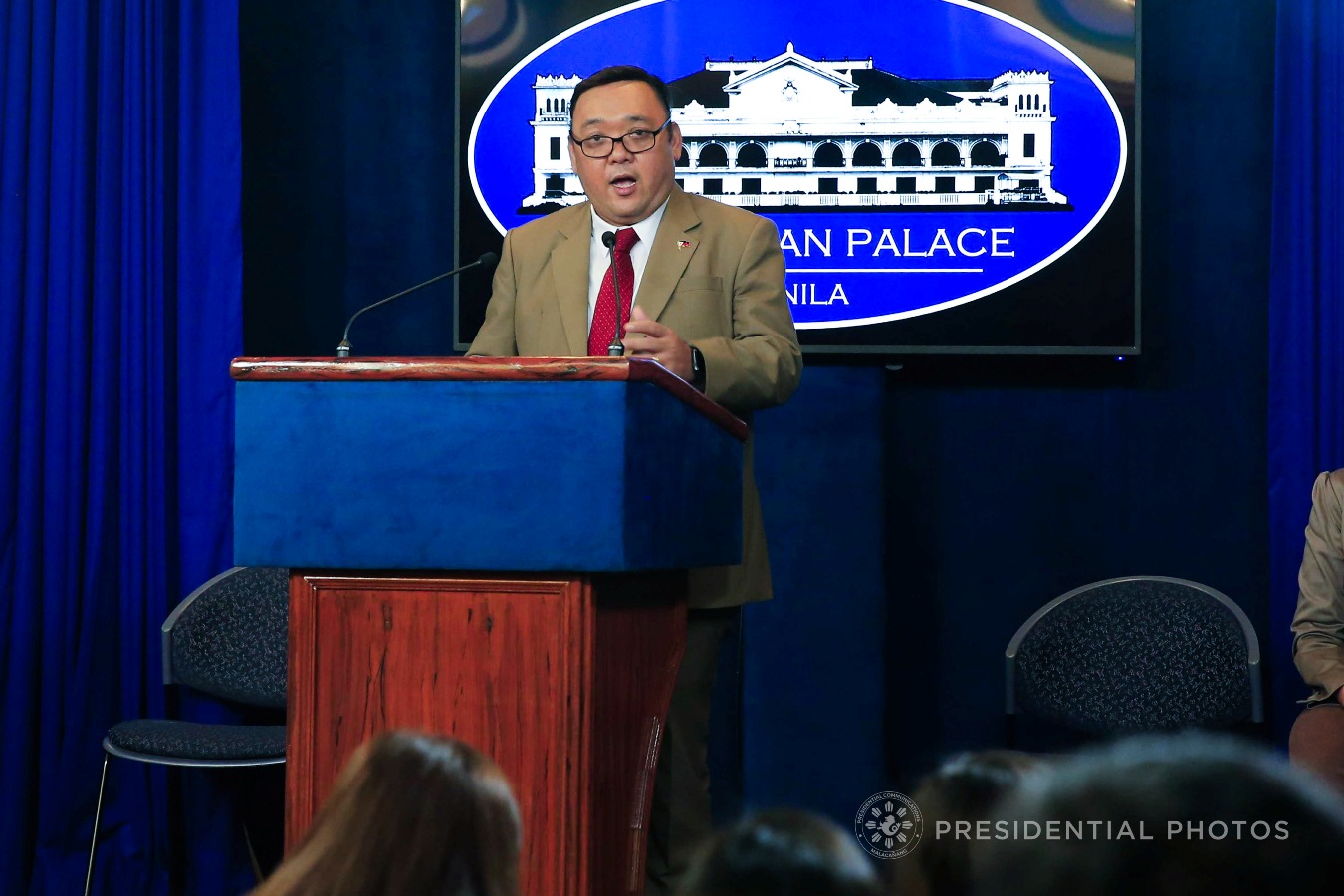

“We are pleased with Fitch Ratings’ upgrade of the Philippines’ Long-Term Foreign-Currency Issuer Default Rating to BBB from BBB-,” Presidential Spokesperson Harry Roque said during a Palace briefing.

“Our stable outlook comes after the country’s strong and consistent macroeconomic performance, sound policies which support high and sustainable growth rates, and strong investor sentiment due to concrete domestic demand and inflows of foreign direct investment,” Roque said.

He noted that the global leader in credit ratings and research likewise forecasted that “the Philippines will have a real gross domestic product (GDP) growth of 6.8 percent in 2018 and 2019 due to expected higher infrastructure spending.”

The administration of President Rodrigo Duterte has embarked on an ambitious infrastructure program aptly named “Build, Build, Build,” that aims to spend an estimated PHP9 trillion on hard and modern infrastructure until 2022.

In its report, Fitch said that the Philippines’ expected 6.8 percent GDP growth in the next two years would maintain the country’s place among the fastest-growing economies in the Asia-Pacific region.

This followed after the Philippines’ GDP rose by 6.9 percent in the third quarter of 2017, beating expectations.

Roque likewise took special note of the fact the Fitch did not see any decline in investor confidence despite the war against drugs, something which critics have been warning about.

“Fitch also noted that investor confidence remains unaffected, citing that ‘there is no evidence so far that incidents of violence associated with the administration’s campaign against the illegal drug trade,” Roque said.

Local and foreign critics of Duterte’s war against illegal drugs have warned that the spate of killing connected with the war on drugs would bring scare off investors.

In its statement, Fitch affirmed that “there is no evidence so far that incidents of violence associated with the administration’s campaign against the illegal drug trade have undermined investor confidence.”

Meanwhile, the Fitch statement also took a positive outlook on one of President Duterte’s priority legislation.

The proposed Tax Reform for Acceleration and Inclusion (TRAIN) bill is currently being heard at the bicameral conference committee and may be signed by President Duterte before the end of the year.

The proposed measure aims to raise PHP130 billion in additional revenues to finance the Duterte administration’s ambitious infrastructure program.

“We estimate the bill to be net revenue positive, reflecting an expansion of the value-added tax base and higher taxes on petroleum products, automobiles, and on sugar-sweetened beverages, which would more than offset a lowering of personal income taxes,” Fitch said. (PNA)