Canada News

Opponents seek to prolong conflict of interest allegations directed at Morneau

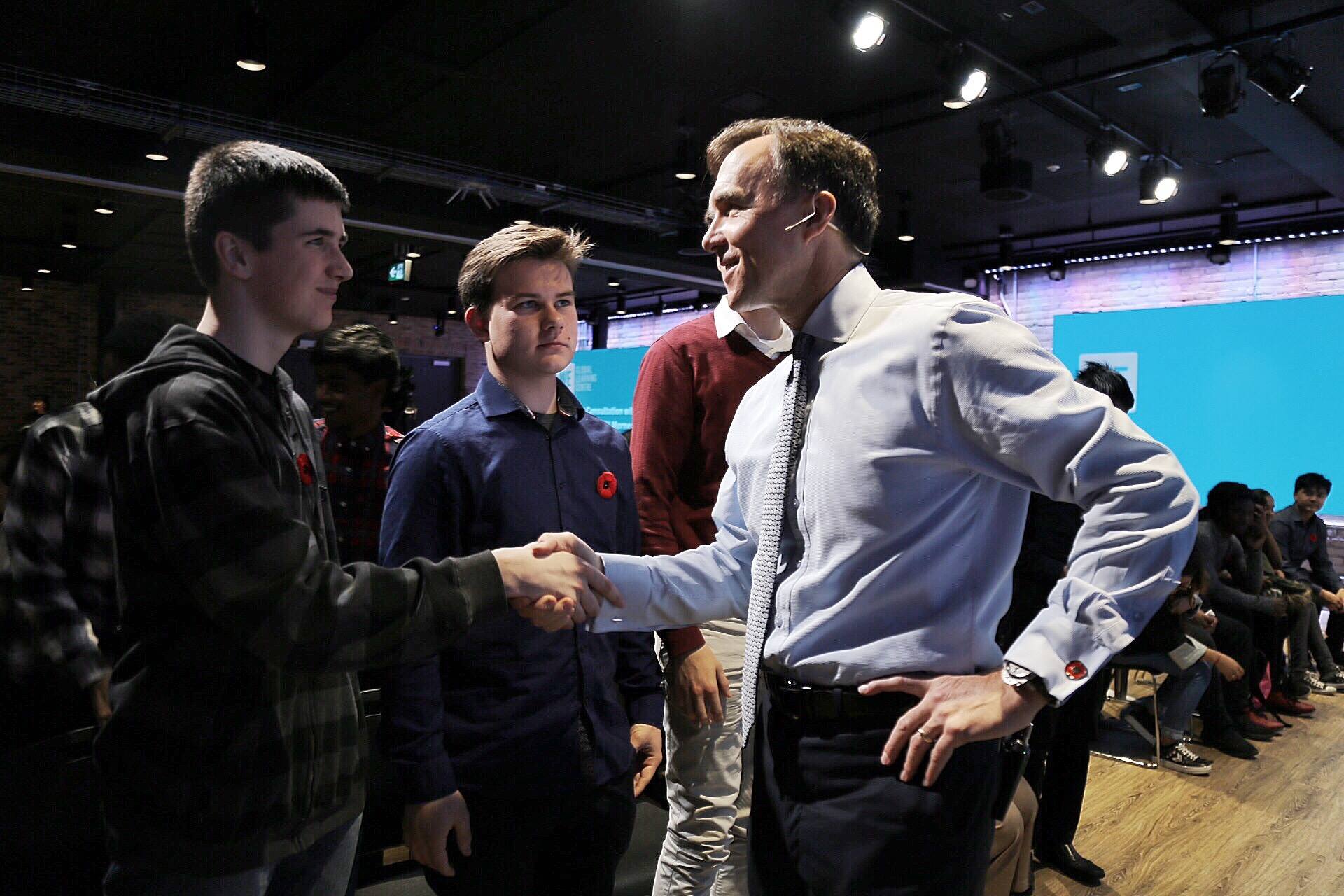

Opposition parties took turns criticizing Bill Morneau on Monday as they tried to drag out a stinging ethics controversy that has swarmed the finance minister for weeks. Back in the House of Commons after a week away in their ridings, opposition MPs zeroed in on Morneau over his involvement in a pension-reform bill that they allege put him in a conflict of interest. (Photo: Bill Morneau/Facebook)

OTTAWA—Opposition parties took turns criticizing Bill Morneau on Monday as they tried to drag out a stinging ethics controversy that has swarmed the finance minister for weeks.

Back in the House of Commons after a week away in their ridings, opposition MPs zeroed in on Morneau over his involvement in a pension-reform bill that they allege put him in a conflict of interest.

Ethics commissioner Mary Dawson has launched a formal examination of Morneau’s work to introduce Bill C-27, which critics insist will benefit his former company in which he owned about $21 million worth of shares.

After the ethics controversy erupted, he sold off his holdings in Morneau Shepell, a human-resources company he built with his father, and vowed to place his other considerable assets in a blind trust.

Morneau announced Monday that he fulfilled another promise to donate the difference between what the shares were worth at the time of the sale and their value in 2015 when he was first elected — an amount estimated at about $5 million. His office said he gave the money to the Toronto Foundation, where the funds will support charities for homeless youth, AIDS awareness, book banks for kids and after-school programs.

That announcement, however, didn’t stop political foes Monday from taking their first crack at questioning Morneau on Dawson’s decision to take a closer look at whether the finance minister was in a conflict of interest.

“The minister just said that now that he has sold all of his shares in Morneau Shepell he can now work on behalf of Canadians,” said Conservative MP Pierre Poilievre, who accused Morneau of hiding behind Dawson.

“What does that say about the last two years while he held those shares? During that time, he introduced a bill creating the very targeted-benefit pension plans that his company designs and profits from.”

New Democrat MP Nathan Cullen said the Liberal government’s pension bill is not only an attack on workers’ pensions, it’s a “massive” conflict of interest involving Morneau.

“It seems this prime minister will walk across broken glass to defend his ethically embattled finance minister, but won’t lift a finger to help out Canadian pensioners,” Cullen said.

In defending Morneau, Prime Minister Justin Trudeau accused opponents of trying to undermine the integrity of the federal ethics watchdog.

Trudeau called their criticisms as nothing but “cheap shots” and “mud-slinging.”

Morneau’s opponents also had fresh fuel for Monday’s attacks.

The Canada Post Pension Advisory Council revealed it had alerted Dawson in a letter on Sept. 18 that Morneau could be in a conflict of interest over the pension bill and its potential benefits for Morneau Shepell.

Dawson, however, only opened an examination earlier this month after media reports shed light on the issue.

Peter Whitaker, an elected official on the council, said Monday that Dawson’s office only responded to his letter Friday after the media started asking her questions about the message.

“It’s frustrating,” said the retired postal worker, who would like to see Bill C-27 abandoned.

Whitaker’s letter also noted that Morneau was executive chair of Morneau Shepell in 2012 when the company acquired the pension administration arm of Mercer Canada Inc., which is the chief actuary for Canada Post. He alleged Morneau Shepell could get an inside track on administrative business related to Bill C-27.

He added that Morneau’s decision to sell his shares was “too little, too late” and insisted the bill is now tainted.

Whitaker also shared an email response he received from Dawson’s office.

It said that while it considers information from the public, the public doesn’t have standing under the Conflict of Interest Act. Her office added that the act does not apply to private companies, therefore it wouldn’t apply to Whitaker’s concerns about Mercer Canada.

On Monday, Dawson’s office issued a public statement: “There is no requirement to follow up on a complaint from a member of the public. However, the commissioner has the discretion to self-initiate an examination, if she has reasonable grounds to believe that the act has been contravened.”

Bill C-27 would amend the Pension Benefits Standards Act so that federally regulated companies and Crown corporations would have the option of setting up target benefit plans for their employees, instead of defined benefit plans.

Morneau introduced it in October 2016, but it has languished on the order paper since then.

Opponents, including unions, say the bill would erode the stability of workers’ defined benefit plans, while proponents say the changes would give employers more flexibility in helping their employees plan for retirement.

Morneau has been facing intense criticism about his integrity for weeks now after information surfaced showing that, based on Dawson’s advice, he had not divested or placed his shares in a blind trust.

“I will continue to work with the ethics commissioner to make sure that her examination is completed,” Morneau said Monday in the House.