Business and Economy

Bank of Canada makes a chunkier rate cut, lowering by half point for 1st time since pandemic

By Jenna Benchetrit, CBC News, RCI

The Bank of Canada located in Ottawa (Photo by Taxiarchos228, CC BY-SA 3.0)

Wednesday’s 50-basis-point cut to 3.75 per cent is twice the size of previous one

The Bank of Canada has lowered its key interest rate to 3.75 per cent, making a 50-basis-point cut for the first time since the COVID-19 pandemic.

Before Wednesday, the rate stood at 4.25 per cent. Economists were expecting the central bank to go with a larger than usual cut, compared to the 25-basis-point downgrades made in June, July and September.

The last time (new window) the bank made a cut this size was on March 27, 2020.

As concerns over inflation have subsided — out-of-control price growth, the catalyst for the central bank’s initial rate-hike campaign, is now back (new window) within the target range — the bank has focused on cutting to keep inflation stable and support economic growth, which has been sluggish (new window) under the pressure of high rates.

We need to stick the landing,

Bank of Canada governor Tiff Macklem told a news conference Wednesday morning.

With inflation back to two per cent, we want to see growth strengthen. Today’s interest rate decision should contribute to a pickup in demand.

WATCH | Bank of Canada governor says we’re back to low inflation:

Bank of Canada governor says data suggests ‘we are back to low inflation’

Bank of Canada Governor Tiff Macklem, who on Wednesday cut the key interest rate to 3.75 per cent, says inflation has come down ‘significantly’ in recent months.

Macklem outlined the economic conditions that informed the bank’s rate cut decision. He noted that core inflation (new window) is within the bank’s target. Housing inflation, which has been driving headline inflation up (new window) for much of the year, is gradually easing, though prices are still elevated. And global oil prices have fallen.

He noted that the economy is seeing an excess of supply of goods and services. Canadians are still cutting back on discretionary spending as inflation and high interest rates have pummelled their purchasing power in the last few years.

Job layoffs have remained modest but business hiring has been weak, which has particularly affected young people and newcomers to Canada. Simply put, the number of workers has increased faster than the number of jobs,

he said.

WATCH | What the Bank of Canada’s chunkier rate cut means for you:

Bank of Canada cuts key rate to 3.75%: What does that mean for consumers?

Earl Davis, head of fixed income and money markets at BMO, speaks with CBC business reporter Scott Peterson to break down the latest Bank of Canada news and explain what it might mean in the months ahead.

Macklem noted that, should the economy continue to evolve broadly in line with the bank’s forecast, further cuts to the policy rate can be expected. But he cautioned that the timing and pace of cuts would depend on incoming economic data and its potential impact on the bank’s inflation outlook.

He repeated a now-familiar refrain, saying that the Bank of Canada will take decisions one meeting at a time.

TD Bank, Scotiabank, BMO, CIBC, RBC and National Bank announced that they had lowered their prime rates by 50 basis points, from 6.45 per cent to 5.95 per cent, on Wednesday afternoon.

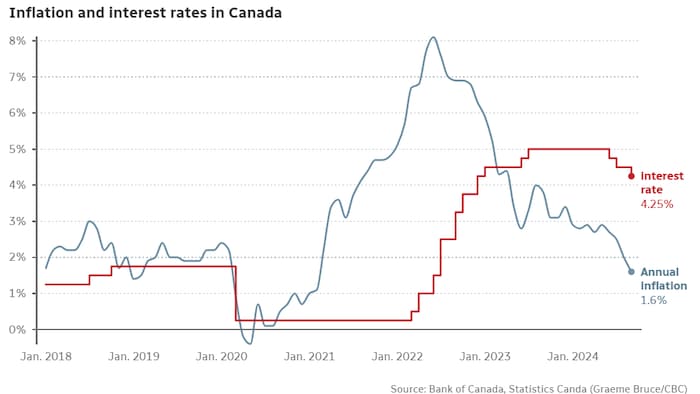

Inflation and interest rates in Canada. Photo: Bank of Canada, Statistics Canda (Graeme Bruce/CBC)

Penelope Graham, a mortgage expert at RateHub.ca (new window), said the lowered rate is immediate good news for variable-rate mortgage holders.

She said fixed-rate mortgage holders won’t see as much of an impact from the Bank of Canada’s decision. Pricing for fixed mortgages is based on the bond market, which is quite reactionary to whatever the central banks are doing,

she explained.

Lowered yields might lead to lower fixed rates, but in the immediate aftermath of today’s announcement, it’s not likely that we’ll see a plunge in terms of pricing.

Why aren’t Canadians feeling relief?

During the news conference, Macklem responded to questions from reporters who asked what he would say to Canadians who aren’t feeling the impact of lower inflation and interest rates in their everyday lives.

It has been a long road back from the high inflation we experienced coming out of the pandemic,

said Macklem. It’s been a long fight, but it’s worked … I think Canadians can breathe a sigh of relief.

One reporter pushed back, saying that many Canadians aren’t feeling relief.

We’re very aware of that,

Macklem responded. You can see it in our own consumer survey. There is a lot of hesitancy. I think the message today is that, with inflation down, Canadians don’t have to worry as much about big changes in their cost of living.

WATCH | BOC official Carolyn Rogers explains why prices are still high as inflation cools:

Prices have increased — and Canadians feel that even as inflation cools, BoC official says

Bank of Canada senior deputy governor Carolyn Rogers says recent years saw many prices shift upward, something Canadians will feel even as inflation slows: ‘Life’s more expensive now than it was two years ago.’

Canadians might not be feeling relief from lower inflation because it doesn’t mean lower prices. A lower inflation rate indicates that prices are still increasing, but doing so at a slower pace.

The reality is people are prudent, they’re preparing for payment shock, they’re saving a lot, they’re not spending as much,

said Stéfane Marion, chief economist with the National Bank.

Please, let’s give them a little bit more breathing room by cutting rates more aggressively. I don’t think that’s going to generate more inflation.

Avery Shenfeld, chief economist of CIBC World Markets, wrote in a note to clients that it would take a significant turn of events to stand in the way of another cut of that magnitude in December.

That said, as has been its practice of late, the bank has kept its options open by not signalling anything specific about the size of individual rate cuts ahead,

Shenfeld wrote.

Meanwhile, economist Tu Nguyen of RSM Canada said the financial institution is forecasting that the bank will return to a smaller, 25-basis-point cut during its next meeting on Dec. 11 so as not to deviate too far from U.S. rates.

This article is republished from RCI.