Business and Economy

$7,800 taken from man’s bank account in case of mistaken identity

By Yasmine Ghania, CBC News, RCI

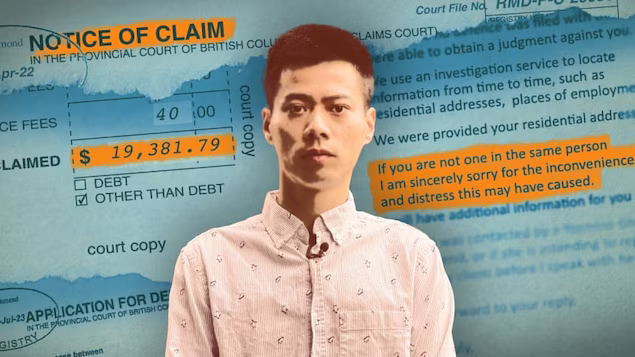

Le Zhang spent almost two stressful weeks trying to recoup thousands of dollars that were taken from his TD Bank account as part of a mistaken garnishing order. Photo: CBC

TD says it will reimburse Le Zhang, offers him an additional $5,000 for ‘frustration’ caused

A Richmond, B.C., man is seeing an unexpected windfall after TD Bank says thousands of dollars were taken from him in a case of mistaken identity.

The bank apologized to Le Zhang on Thursday, saying it froze his account in error

— almost two weeks after the 36-year-old was shocked to find about $7,800 had been withdrawn in the form of a legal demand payment on Aug. 9.

I just can’t believe how this happened,

Zhang said in an interview with CBC News the day before. I just can’t sleep. I can’t even eat … I don’t know how I’m going to survive through this.

After noticing the withdrawal and going back and forth with his bank, Zhang found out the money was seized as part of a garnishing order — a legal order to seize a person’s funds — of about $19,000 related to a water leak in a condo building in Richmond.

He said he was told by a bank representative that the rest of the money would come out of his account once more funds were deposited. His chequing account sat at $0 as of earlier this week.

But court and property records reviewed by CBC News show Zhang didn’t own or live in the building in question — a man with a similar name did.

After CBC News looked into the matter, TD apologized, saying it had received incorrect information

from a third-party tool that is used to identify people involved in insurance claims and legal matters.

The bank says it will reimburse Zhang for the full amount that was taken from him and has also offered him an additional $5,000 for his frustration.

Zhang, an education assistant and father of two, says he’s extremely relieved TD is giving back his money as he has an upcoming mortgage payment and bills, and few savings.

This should have happened on day one,

he said.

The leak at the heart of matter

A notice of claim laying out the alleged water damage lists Leo Zhang and the unit’s registered owner as defendants.

It states the location of the incident as happening on a street that Le did once live on, but lists a completely different building and unit number.

Le Zhang insists he does not know the defendants, the unit’s occupants, nor owner.

CBC News contacted the registered owner in China. She said she was not aware of the notice of claim as she hasn’t been in Canada in years and plans to look into the matter.

WATCH | How TD’s withdrawal affected Zhang’s finances, health:

TD Bank’s mistaken withdrawal big hit to man’s finances

Le Zhang, who had nearly $8,000 taken out of his TD Bank account, spoke to CBC News about the difficult financial position the withdrawal left him in. Days later, TD said the money was taken in error in a case of mistaken identity.

Zhang was mailed the notice of claim in 2022 to the house that he bought after selling his condo.

Precision Paralegal said it got his address through an investigative service

that it uses from time to time to locate information such as residential addresses and places of employment.

The certificate of service obtained by CBC News says Leo Zhang

was served. Le Zhang says he doesn’t recall receiving the notice of claim and wouldn’t have opened it if it had a different name on it.

If you are not one and the same person I am sincerely sorry for the inconvenience and distress this may have caused,

the paralegal service provider said in an email to Zhang before TD resolved the matter.

According to the notice of claim, a couple who own a condo unit below Leo Zhang noticed water pooling in the ceiling of the laundry area in May 2021.

It was determined that the damages were a result of water leaking from the unit directly above the property,

the notice of claim said.

Thousands in damages

A plumber advised Leo to stop using the washing machine for the time being.

But he continued to use it, resulting in more water damage and emergency repairs, according to the document, which alleged negligence and lack of care.

The couple’s property was ensured by Security National Insurance Company (SNIC), an underwriter for TD Insurance.

SNIC paid out about $18,000 while TD Insurance paid a deductible of $1,000 due to the resulting damage from the water and the subsequent insurance claim,

according to the notice of claim. Hundreds more dollars have since been added to Leo’s tab related to court fees.

A statement of defence wasn’t filed. As a result, Precision says it got the order to seize funds from Le Zhang.

CBC News has attempted to contact Leo Zhang through several phone numbers and social media accounts that matched this name.

‘Banks should be double-checking with customer’

Precision declined to answer questions from CBC News, deferring the matter to TD Insurance.

TD Bank Group declined an interview.

In a statement, it said, this is not an experience that is representative of TD Insurance and we understand the frustration this would have caused. TD Insurance is committed to supporting its customers and is working directly with this individual to remediate.

Democracy Watch co-founder and bank accountability advocate Duff Conacher described Zhang’s case as a very unusual situation.

I think the banks should be double-checking with the customer before they allow a transaction like this to go through,

Conacher said in an interview.

Zhang says the ordeal has left him distrustful of TD.

I’m changing my bank for sure,

he said.

This article is republished from RCI.