Business and Economy

Balisacan: Further rate hike to hurt economy

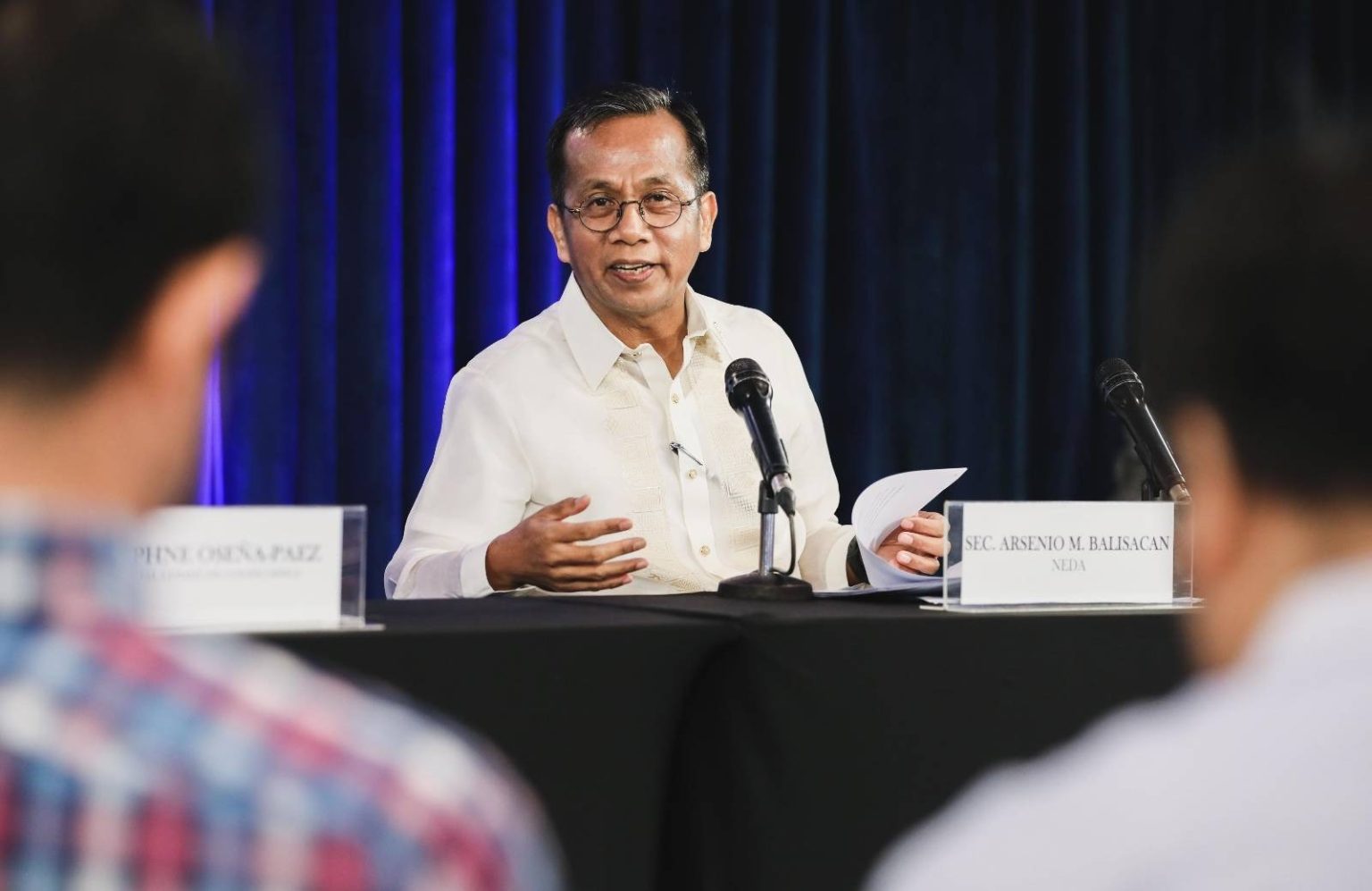

“If I were in the Monetary Board, I would say no [to policy rate hike]. Because we have been the most aggressive in our region in raising interest rates,” said Balisacan at a briefing on Friday. (PCO File Photo)

“If I were in the Monetary Board, I would say no [to policy rate hike]. Because we have been the most aggressive in our region in raising interest rates,” said Balisacan at a briefing on Friday.

The BSP’s Monetary Board has hiked interest rates by a total of 425 basis points since last year to temper the rising inflation.

“We know that raising the interest rates will hurt the economy, will hurt the consumers and producers. That has long-term effects also in the succeeding 12 months. On the other hand, we know also very well that the source of the inflation is on the supply side, it’s not the usual demand side that requires monetary solution,” said Balisacan.

BSP Governor Eli Remolona Jr. earlier disclosed that rate hikes are still possible as inflation remains elevated. During its last meeting, the Monetary Board kept key rates at 6.

25 percent.

Headline inflation accelerated to 6.1 percent in September from 5.3 percent in August.

Balisacan said that a rate hike won’t be necessary as core inflation continues to decline.

Core inflation which excludes volatile oil and food items, went down to 5.

9 percent from 6.1 percent in August.

“Core inflation is declining compared to the headline inflation so if you base it there, then there’s really no urgency in creating another round of high interest rates. Higher interest rates will really put us too far away from our peers in the region,” said Balisacan.

Balisacan said that while the economy will still be able (to) withstand another round of rate hike, “if it’s unnecessary, why force it?”

“I look at how our neighbors, how we have been using our monetary tools to address inflation and other concerns, we see that our policy rates stand out. And that’s not something that we can be proud of because that increases the cost of production, that’s also depressing consumer demand so the whole domestic demand is going to be affected and the impact is longer term,” he said.

“If they do it now, you’ll still feel the impact 12 months down the road. But we should also do our work in the executive, address supply-side issues because where the inflation is coming from is not excess demand,” he added.

Balisacan said further raising interest rates will also have an effect on the peso.

“Our position is to ensure that the peso remains competitive because a very strong peso relative to our trading partners and peers in the region, hurt our exporters, local producers,” he said.

Inflation, growth target still doable

Balisacan meanwhile said that despite the pick up in inflation last month, the higher end of the government’s 2 to 4 percent inflation target is still achievable.

“The 4 percent there might still be achievable. There’s still three months,” he said.

In terms of economic growth, Balisacan said the lower end of the 6 to 7 percent target is also still doable.

“We are not giving that up. But even if the target is reduced from say to 5.5 to 6.5 percent, that’s still…even if it’s slightly below 6 [percent], it’s not something that we should cry about because it’s still one of the best performing economies in the Asia Pacific region,” said Balisacan.

Balisacan said almost all growth targets in the Asia Pacific have been reduced because of the weakening global market.