Philippine News

Covid-19 jab funds enough to cover teens: DOF

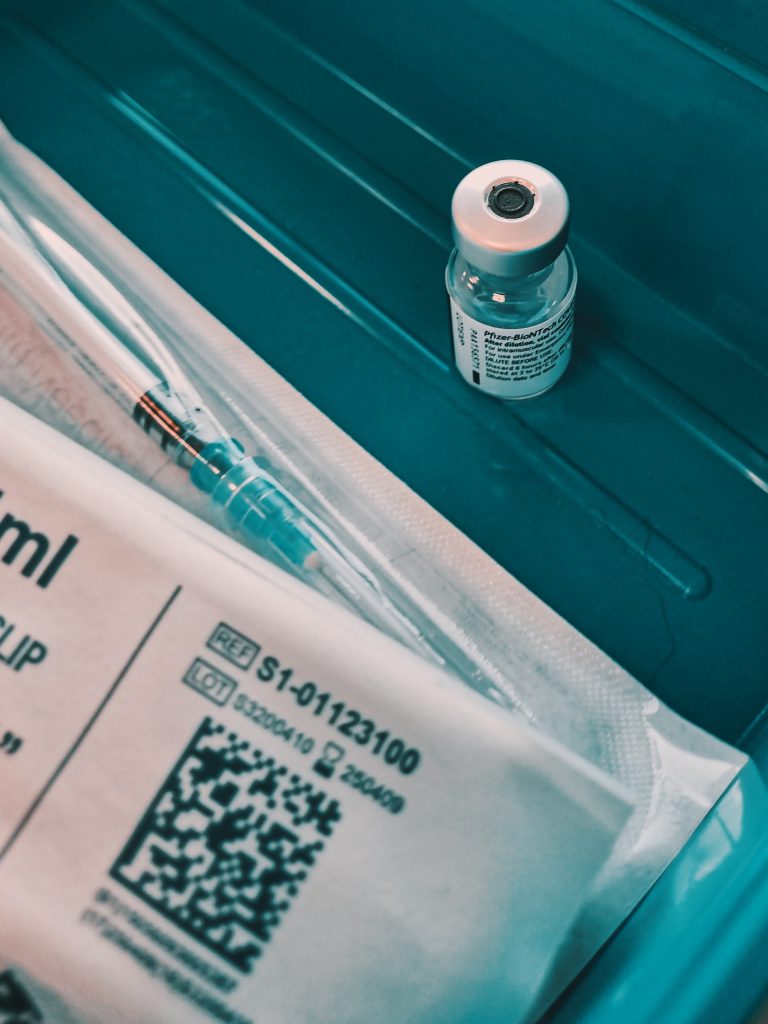

MANILA – The government has enough funds to procure vaccines against the coronavirus disease 2019 (Covid-19) even for teenagers, Finance Secretary Carlos Dominguez III said.

In a pre-recorded Cabinet meeting with President Rodrigo Duterte on Monday night, Dominguez said Congress has authorized the government to spend PHP12.5 billion to purchase Covid-19 vaccines while about PHP58.5 billion has been sourced from multilateral lenders for the same purpose.

Up to PHP11.5 billion is also available from other financing sources as necessary and PHP2.5 billion is available as a contingency fund, he said.

Dominguez said the PHP85 billion is enough to procure vaccines for the estimated 70 million adult population, at two doses per individual, and for the estimated 15 million teenagers.

He estimated the vaccines for teenagers to cost PHP20 billion.

“Sapat po yung pera natin para sa (Our funds are enough for the) vaccination, so we don’t have to worry. The money is there and we will certainly be able to vaccinate the entire adult population plus the teenagers, who are, I think, around 15 million. So total, 85 million Filipinos,” he said.

Of the total budget, Dominguez said Congress has approved the allocation of PHP2.5 billion for vaccine procurement under the Department of Health’s (DOH) budget for this year while PHP10 billion has been allotted under the Bayanihan to Recover as One Act (Bayanihan 2), the validity of which has been extended until June 30.

Relatively, the PHP58.5 billion from official development assistance (ODA) is accounted for by the PHP23.9 billion (USD500 million) borrowed from the World Bank (WB), PHP20.3 billion (USD425 million) from the Asian Development Bank (ADB), and PHP14.3 billion (USD300 million) from the Asian Infrastructure Investment Bank (AIIB).

He said these funds are on top of ones that could be tapped from other financing sources and the contingency fund.

Even if government borrowings have increased because of the need to spend to address the pandemic’s impact, Dominguez said this is only temporary.

He said “it is not a permanent situation” and pointed out that “once we open the economy, our revenues will go back and once we beat Covid, our expenditures for Covid are also going to go down.”

“So we (are) going to become normal again probably in 2022, probably in 2023. We are going to become normal like 2019 when our deficit is much lower,” he added.

Government borrowings rose from PHP1 trillion in 2019 to PHP2.7 trillion in 2020 and are estimated to reach PHP3.1 trillion this year.

In 2019, government borrowings accounted for 30.96 percent of the gross domestic product (GDP) but it rose to 54.5 percent of domestic output in the following year and is projected to hit 58.7 percent this year.

Because of the lockdowns implemented to address the spread of Covid-19, government revenues were hit because of the decline in economic activities.

Total revenues in 2019 amounted to PHP3.14 trillion but it went down to PHP2.86 trillion in 2020 and is estimated to amount to PHP2.88 trillion this year.

On the other hand, from PHP3.8 trillion worth of spending in 2019, government spending rose to PHP4.23 trillion last year due to pandemic-related financing. It is estimated to further rise to PHP4.7 trillion this year.

As a result, the budget gap increased from about PHP660 billion in 2019 to PHP1.37 billion last year.

The projected budget deficit this year is about PHP1.86 trillion.

In terms of its share of domestic output, the budget gap rose from 3.4 percent in 2019 to 7.6 percent in 2020 and is estimated to be 9.3 percent of the GDP this year.

Amid these developments, Dominguez said the country’s investment-grade ratings remain intact, unlike the more than 100 countries that suffered credit rating downgrades since last year because of the impact of the pandemic.

A credit rating downgrade will make it difficult for countries to borrow funds from various lenders or if ever they are able to borrow, interest rates will be higher, he said.

“Our interest rate, actually, is quite low because our credit rating is very good. So, we think that the debt level of our country is high but it is sustainable and we can manage to handle this debt in the coming years,” he added.