Business and Economy

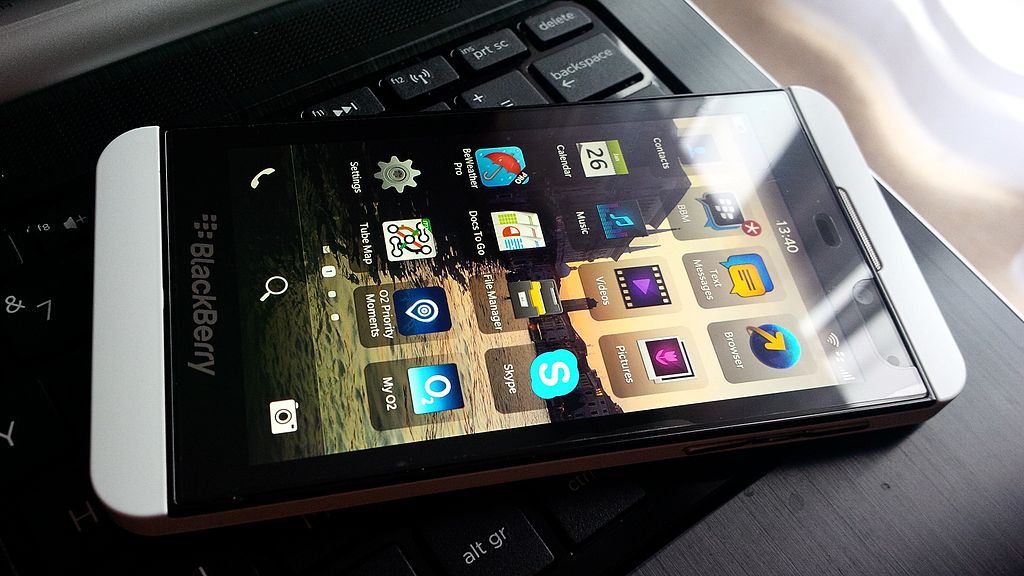

BlackBerry says it hasn’t engaged with Samsung over a potential takeover

TORONTO — BlackBerry has responded to a dramatic jump in its stock price, saying late Wednesday that it has not engaged in discussions with Samsung Electronics Co. Ltd. about a possible takeover.

The response followed a report from Reuters news agency which said Samsung had met with BlackBerry executives over the possibility of buying the Canadian company for as much as US$7.5 billion. The news agency cited both a source familiar with the proposal and related documents.

BlackBerry shares jumped nearly 30 per cent after the report emerged, leading the company to react with a public statement.

“BlackBerry has not engaged in discussions with Samsung with respect to any possible offer to purchase BlackBerry,” the company said.

The comments did not address whether Samsung had expressed an interest in the company that BlackBerry executives haven’t entertained.

However, the company said its policy is “not to comment on rumours or speculation and, accordingly, it does not intend to comment further.”

A representative for South Korea-based Samsung declined to comment, though this isn’t the first time the technology rivals have worked together.

BlackBerry and Samsung announced a partnership last November where the Waterloo, Ont.,-based company made its mobile security technology available for the Android operating system.

For BlackBerry, the arrangement gave their software the ability to work on Samsung’s Galaxy and Note smartphones, while it provided Samsung an opportunity to get the attention of business customers that BlackBerry courts.

Samsung has been focused on selling its Knox security software to the business community in an effort to compete against similar offerings being developed by Apple Inc. and others.

“What Samsung needs is credibility in the business space, which is what BlackBerry is pivoting towards at this point,” said Carmi Levy, analyst and writer at Voices.com, a London, Ont.-based web technology company.

“There’s a lot of complementary benefits for both of these companies to get together.”

BlackBerry has been in the crosshairs of interested buyers in the past. Last fall, Chinese company Lenovo was considered a potential bidder though an offer never materialized.

Chief executive officer John Chen has said he is focused on turning around operations at the company rather than hunting for buyers.

Traders reacted to the Reuters report by sending BlackBerry’s stock to its highest level since early 2012 on the Toronto Stock Exchange.

Its shares closed Wednesday at C$15.02, an increase of $3.42 or almost 30 per cent.

In New York, BlackBerry shares closed up US$2.89 at US$12.60.

After BlackBerry issued its statement, traders appeared to show some hesitation, pulling the company’s stock back .

97 to US$10.63 by shortly after 7 p.m. ET in after hours trading.

According to the report, Samsung had proposed a range of US$13.35 to US$15.49 per share in its initial approach to BlackBerry. The offer would be a premium of 38 to 60 per cent over BlackBerry’s stock price before the report emerged.

Offers for BlackBerry by an international buyer could raise concerns from the federal government, which would review any foreign takeover bid.

Finance Minister Joe Oliver declined to comment on whether the federal government had received notice from BlackBerry about interest from Samsung or any other buyers.